Understanding Co-lending Model

Co-lending is when both, banks and NBFCs work together to provide a loan.

Picture it like a team effort: the bank and the NBFC join forces to share the risk and rewards of lending money. The bank (Investor) usually contributes most of the loan amount (>= 80%), while the NBFC (Originator) chips in with the rest. This setup helps get loans to more people, especially those who might not have easy access to credit.

Challenge

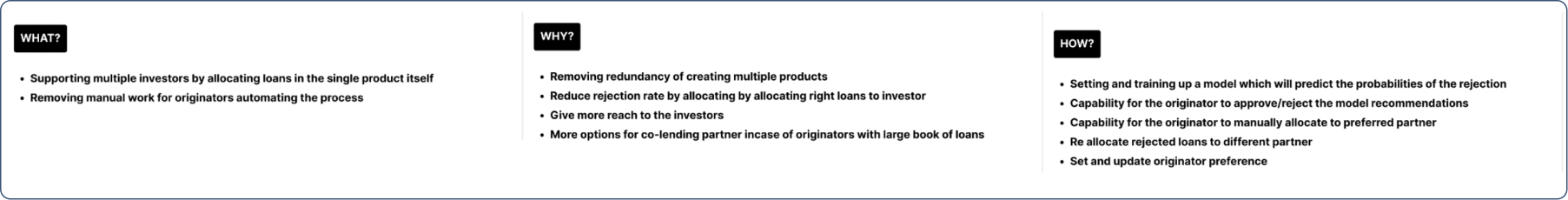

In a typical co-lending platform, each product (group of loans) typically has only one investor. However, this can create challenges when multiple investors want to invest in loans from the same ‘product’, or when originators have many loans to co-lend.

To address this, some systems duplicate products to set up separate agreements, but this can lead to confusion and redundancy. In such cases, originators must manually decide which loans go to which investors, which can increase rejection rates if the matching criteria aren’t met.

Note: Yubi Co.lend is a large platform where I worked for an year. However, this case study will focus only on the ‘Loan Allocation AI’ feature, which lasted for two months

Goals

- Reduce rejection rate by allocating the right loans to investors

- Give more reach to the investors as per their lending appetite

- More options of co lending partners in case of originators with large book of loans

Approach

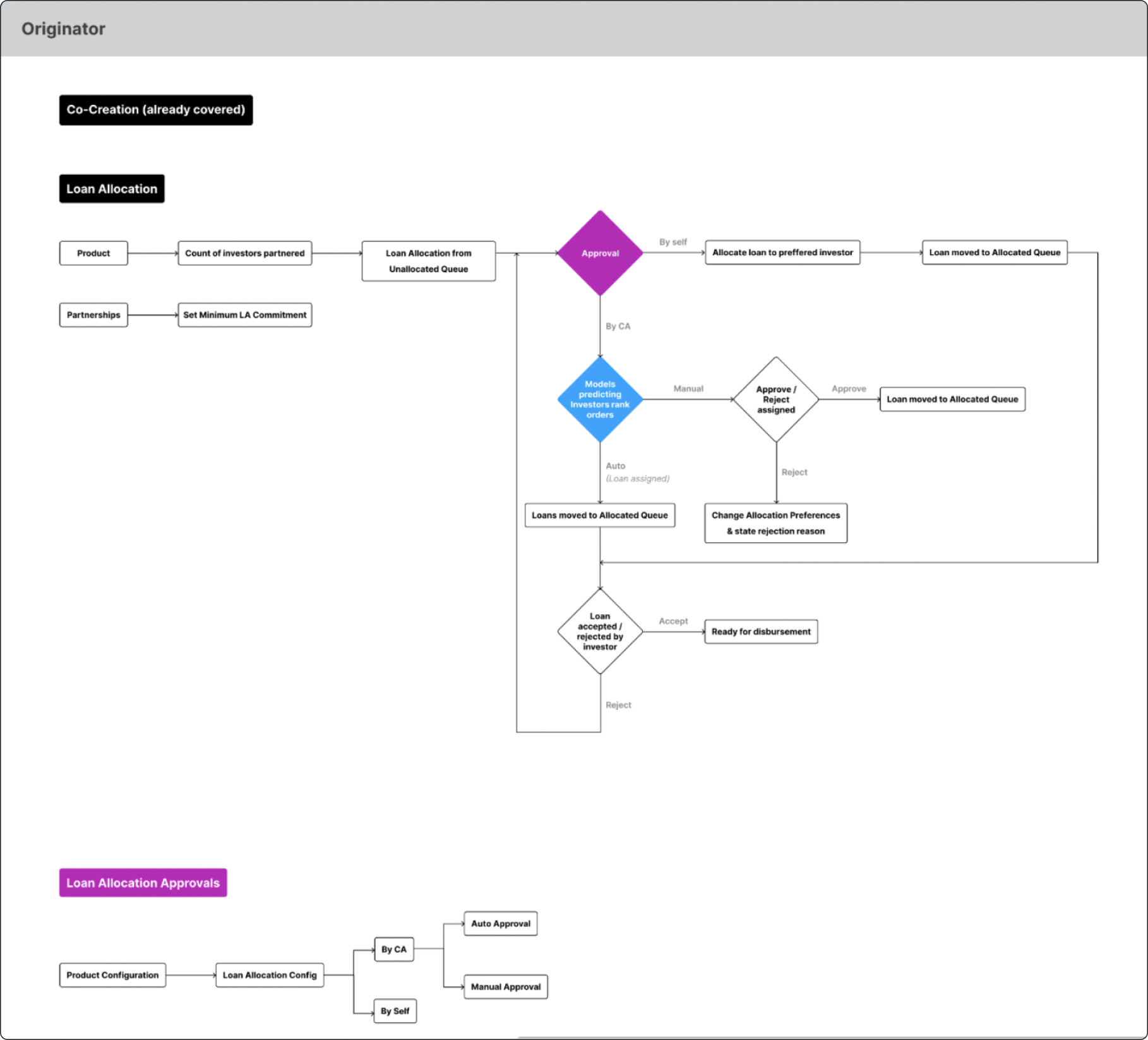

Understanding Loan Allocation Model

- Loan Scoring: Pending loan applications are scored against all investors to predict acceptance or rejection. Historical patterns inform this prediction.

- Batch Scoring: Borrowers are scored against investors in batches and stored in a database.

- Batch Updates: When borrower values change (e.g., new loans or defaults), the model reevaluates and updates the database.

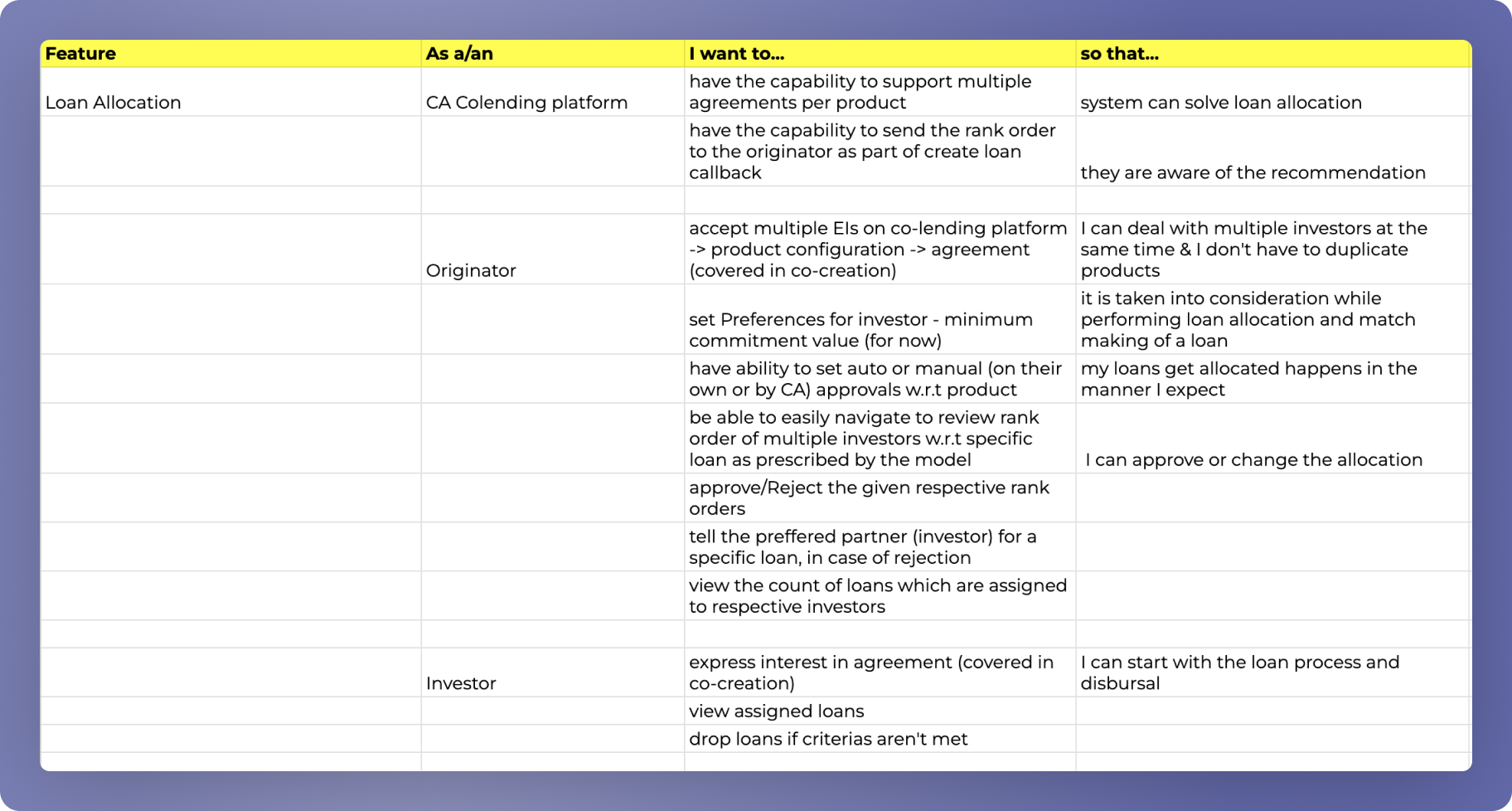

User Stories

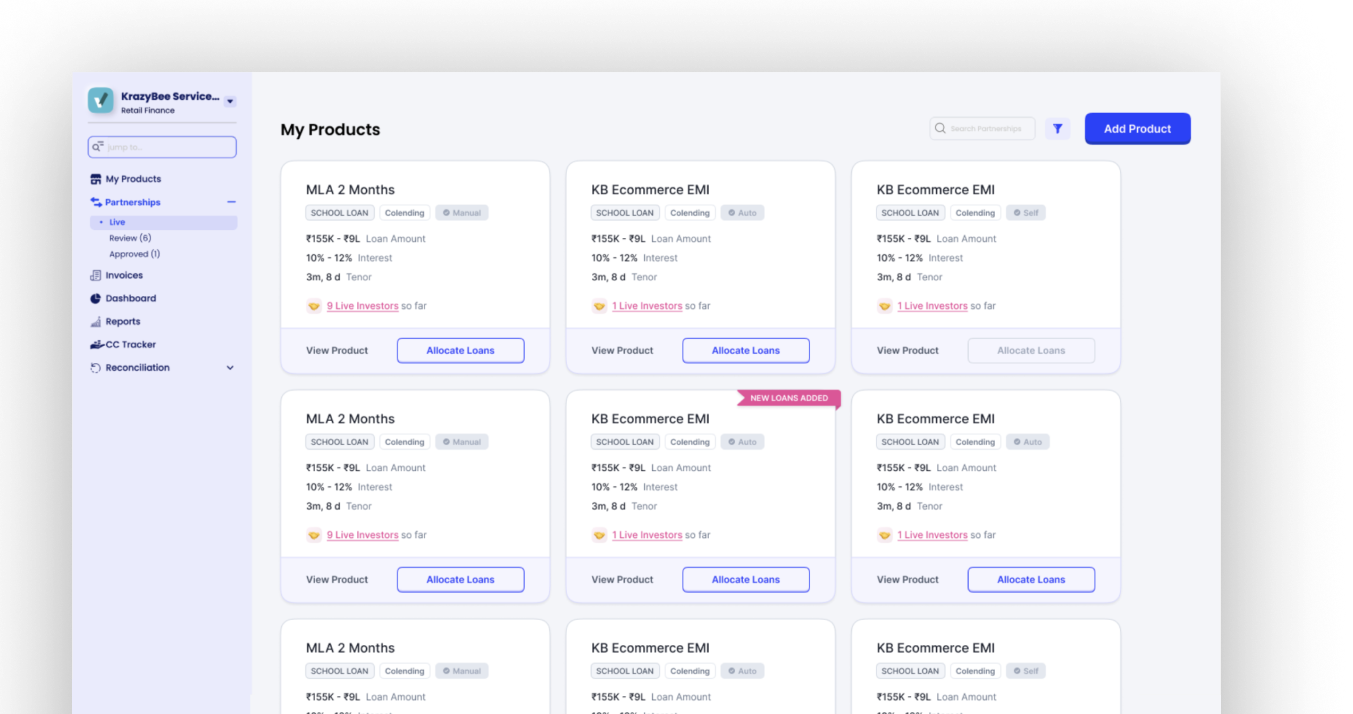

IA

Starting from basic features to complex ones, IA was prepared based on technical feasibility.

Media Coverage

Results